CRYPTO ASSET EXCHANGES PLAYING OPEN CARDS WITH SARS?

SARS has been honing its “automatic exchange of information” process with various countries and financial institutions, and it seems Crypto Asset Exchanges have now joined the party!

Though not entirely unprecedented or unexpected, to crypto asset traders or investors, this revelation can easily spell out the beginning of the end, where historic crypto related profits or gains have gone undeclared.

Head of Crypto Asset Compliance at Tax Consulting SA

FEATURED IN

If you have been in the crypto game for a while, or maybe spent some time in the metaverse, transparency on these activities is essential. That borne in mind, practically, we have seen scores of instances where profits or gains derived from crypto asset disposals have not been declared to SARS, either due to a lack of knowledge, or out of fear from the repercussions.

Crypto Assets Next Target in SARS’ Compliance Crusade

SARS has made clear their mandate to collect revenue by whatever means necessary and ensure a culture of compliance, which to date, has included, but is not limited to:

- Deep-diving into historic audits on wealthy individuals;

- Obtaining transactional records directly from banks; and

- Implementing new enhanced compliance processes on international transfers of funds.

The fruits of these labours were evident in the presentation of SARS’ Annual Performance Plan 2024/25, showing significant increases in revenue collections. In what can only be a bold move, SARS also highlighted its next strikes, being the 5 “must-win” battles, which includes “Leverage our resources (people, data and technology) and achieve more with less”.

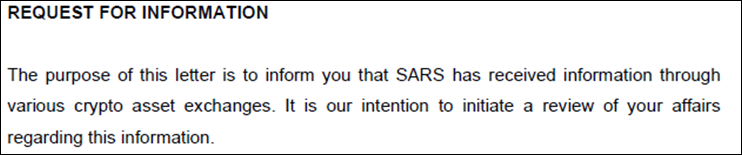

There can be no doubt in one’s mind, that this includes data driven insights, subject to enhanced processing, and certainly includes transactional records from Crypto Asset Exchanges. In concretizing the interpretation of this “must-win” battle, the below excerpt from a Request for Information, should be considered by all Crypto enthusiasts:

Excerpt from SARS Request for Information, pertaining to undeclared crypto asset transactions

Validity of Information Verification

With the number of scams going around, claiming to be collections by SARS, and even requesting confidential information, whilst providing the scammers banking details for payment, taxpayers must always be careful as to what information is shared.

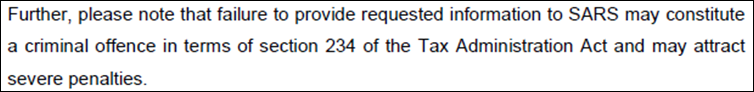

When receiving any request for information, especially one requesting not only confirmation of your crypto trading activity, but also your wallet and blockchain addresses, together with all trading account details, the priority is always to verify the validity of such request:

Excerpt from SARS Request for Information, pertaining to undeclared crypto asset transactions

Typically, where there has been a failure to correctly declare crypto related profits or gains, we see taxpayers going into panic mode and hastily submitting what they can, or, simply ignoring the request, only to be shocked with a subsequent adverse finding and large tax bill!

Become Crypto Compliant Today, Legally

As a rule of thumb, any and all correspondence received from SARS, should be immediately addressed. Where taxpayers know they are in the wrong, it is market best practice to seek the guidance of a specialist tax attorney. This not only ensures you are not subjecting yourself to a scam artist, and allows legal verification of any requests received, but also grants you legal professional privilege and guidance on the correct legal remedy.

Not only will this place you in a better position of knowledge, but when the correct tax and legal strategy is followed, pro-actively, it will ensure both historic and current compliance with SARS.

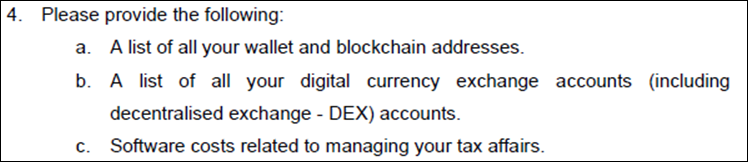

Should SARS have already contacted you on any inaccuracy or concomitant liability arising from your cryptocurrency transactions, this should be immediately addressed, by a multi-faceted team of professionals. This expert intervention will not only serve to safeguard you against SARS implementing punitive measures, but also being specialists in their own right, you will be correctly advised on the most appropriate solution to ensure your tax compliance, and avoid possible prison time:

Excerpt from SARS Request for Information, pertaining to potential criminal charges